Mục lục . Content

- 1. Law 13/2008/QH12 on Value-added Tax

- Chapter I. GENERAL PROVISIONS

- Chapter II. TAX BASES AND TAX CALCULATION METHODS

- Chapter III. TAX CREDIT AND REFUND

- Chapter IV. IMPLEMENTATION PROVISIONS

- 2. Law 31/2013/QH13 (Amending Law 13/2008/QH12)

- Article 1.

- 1. To amend and supplement Clauses 4, 7, 8, 11, 15, 17, 23 and 25, Article 5 as follows:

- 2. To amend and supplement Points a, b, and d, Clause 1, Article 7 as follows:

- 3. To amend and supplement Clause 1, Article 8; to supplement Point q to Clause 2, Article 8 as follows:

- 4. To amend and supplement Article 10 as follows:

- 5. To amend and supplement Article 11 as follows:

- 6. To amend and supplement Article 12 as follows:

- 7. To amend and supplement Article 13 as follows:

- Article 2.

- 3.Law 71/2014/QH13 (Amending Law 13/2008/QH12)

- Article 3.

- Article 6.

- 4. Law 106/2016/QH13 (Amending Law 13/2008/QH12)

- Article 1

- Article 4

1. Law 13/2008/QH12 on Value-added Tax,

2. Law 31/2013/QH13 (Amending Law 13/2008/QH12),

3. Law 71/2014/QH13 (Amending Law 13/2008/QH12),

4. Law 106/2016/QH13 (Amending Law 13/2008/QH12).

—

(English – Tiếng Anh)

1. Law 13/2008/QH12 on Value-added Tax

LAW 13/2008/QH12

June 03, 2008

ON VALUE-ADDED TAX

Pursuant to the 1992 Constitution of the Socialist Republic of Vietnam, which was amended and supplemented under Resolution No. 51/2001/QH10;

The National Assembly promulgates the Law on Value-Added Tax.

Chapter I. GENERAL PROVISIONS

Article 1. Governing scope

This Law provides for objects subject and not subject to value-added tax, taxpayers, tax bases, tax calculation methods, and tax credit and refund.

Article 2. Value-added tax

Value-added tax is a tax imposed on the added value of goods or services arising in the process from production, circulation to consumption.

Article 3. Taxable objects

Goods and services used for production, trading or consumption in Vietnam are subject to value-added tax, except those specified in Article 5 of this Law.

Article 4. Taxpayers

Taxpayers include organizations and individuals producing or trading in goods or services subject to value-added tax (below referred to as business establishments) and organizations and individuals importing goods subject to value-added tax (below referred to as importers).

Article 5. Non-taxable objects

1. Cultivation and husbandry products, and reared and fished aquatic products which have not yet been processed into other products or have been just preliminarily processed and sold by producing and fishing organizations and individuals, and products at the stage of importation.

2. Products which are animal breeds and plant varieties, including breeding eggs, breeding animals, seedlings, seeds, sperms, embryos and genetic materials.

3. Irrigation and drainage; soil ploughing and harrowing; dredging of intra-field canals and ditches for agricultural production; services of harvesting farm produce.

4. Salt products made of seawater, natural rock salt, refined salt and iodized salt.

5. State-owned residential houses sold by the State to current tenants.

6. Transfer of land use rights;

7. Life insurance, student insurance, insurance on domestic animals, insurance on plants and reinsurance.

8. Credit provision services; securities trading; capital transfer; derivative financial services, including interest-rate swap contracts, forward contracts, futures contracts, call or put options, foreign currency sales, and other derivative financial services as prescribed by law.

9. Healthcare and animal health services, including medical examination and treatment and preventive services for humans and domestic animals.

10. Public post and telecommunications and universal Internet services under the Governments programs.

11. Public services on sanitation and water drainage in streets and residential areas; maintenance of zoos, flower gardens, parks, street greeneries and public lighting; funeral services;

12. Renovation, repair and construction of cultural, artistic, public service and infrastructure works and residential houses for social policy beneficiaries, which are funded with peoples contributions or humanitarian aid.

13. Teaching and vocational training as provided for by law.

14. State budget-funded radio and television broadcasting.

15. Publication, import and distribution of newspapers, journals, specialized bulletins, political books, textbooks, teaching materials, law books, scientific-technical books, books printed in ethnic minority languages as well as propaganda postcards, pictures and posters, including those in the form of audio or visual tapes or discs or electronic data; money printing.

16. Mass transit by bus and tramcar.

17. Machinery, equipment and supplies which cannot be manufactured at home and need to be imported for direct use in scientific research and technological development activities; machinery, equipment, spare parts, special-purpose means of transport and supplies which cannot be manufactured at home and need to be imported for prospecting, exploring and developing oil and gas fields; aircraft, drilling platforms and ships which cannot be manufactured at home and need to be imported for the formation of enterprises fixed assets or which are hired from foreign parties for production and business activities or for lease.

18. Special-purpose weapons and military equipment for security and defense purposes.

19. Goods imported as humanitarian aid or non-refundable aid; gifts for state agencies, political organizations, socio-political organizations, socio-political-professional organizations, social organizations, socio-professional organizations or peoples armed forces units; donations or gifts for Vietnam-based individuals within the Government-prescribed quotas; belongings of foreign organizations and individuals within diplomatic immunity quotas; and personal effects within duty-free luggage quotas.

Goods and services sold to foreign organizations or individuals or international organizations for use as humanitarian aid, and non-refundable aid to Vietnam.

20. Goods transferred out of border gate or transited via the Vietnamese territory; goods temporarily imported for re-export; goods temporarily exported for re-import; raw materials imported for the production or processing of goods for export under contracts signed with foreign parties; goods and services traded between foreign countries and non-tariff areas and between non-tariff areas.

21. Technology transfer under the Law on Technology Transfer; transfer of intellectual property rights under the Law on Intellectual Property; computer software.

22. Gold imported in the form of bars or ingots which have not yet been processed into fine-art articles, jewelries or other products.

23. Exported products which are unprocessed mined resources or minerals as prescribed by the Government.

24. Artificial products used for the substitution of diseased peoples organs; crutches, wheelchairs and other tools used exclusively for the disabled.

25. Goods and services of business individuals who have a monthly income lower than the common minimum salary level applicable to domestic organizations and enterprises.

Establishments trading in non-taxable goods or services specified in this Article are not entitled to input value-added tax credit or refund, except the cases subject to the tax rate of 0% specified in Clause 1, Article 8 of this Law.

Chapter II. TAX BASES AND TAX CALCULATION METHODS

Article 6. Tax bases

Value-added tax bases include taxable price and tax rate.

Article 7. Taxable price

1. The taxable price is specified as follows:

a/ For goods and services sold by business establishments, the taxable price is the selling price exclusive of value-added tax. For excise tax-liable goods and services, the taxable price is the selling price inclusive of excise tax but exclusive of value-added tax;

b/ For imported goods, the taxable price is the border-gate import price plus import tax (if any) and excise tax (if any). The border-gate import price shall be determined under regulations on prices for calculating import tax;

c/ For goods and services used for barter, internal consumption or donation, the taxable price is the price for calculating value-added tax on goods and services of the same or equivalent kinds at the time of barter, consumption or donation;

d/ For asset lease, the taxable price is the rent exclusive of value-added tax;

In case of asset lease for which rents are paid periodically or in advance for a certain lease duration, the taxable price is the rent paid periodically or in advance, exclusive of value-added tax;

In case of hiring foreign machinery, equipment or means of transport which cannot be manufactured at home for sublease, the taxable price excludes the rent payable to the foreign party;

e/ For goods sold by mode of installment or deferred payment, the taxable price is the lump-sum selling price of such goods, exclusive of value-added tax, excluding the interest on installment or deferred payment;

f/ For goods processing, the taxable price is the processing remuneration exclusive of value-added tax;

g/ For construction and installation activities, the taxable price is the value of the handed-over work, work item or job, exclusive of value-added tax. If construction or installation activities do not cover materials, machinery or equipment, the taxable price is the construction or installation value, excluding the value of materials, machinery or equipment;

h/ For real estate trading, the taxable price is the real estate-selling price exclusive of value-added tax, excluding the charge for transferring land use rights or the land rent remittable into the state budget;

i/ For commission-enjoying goods or service trading agency and brokerage, the taxable price is the commission on these activities, exclusive of value-added tax;

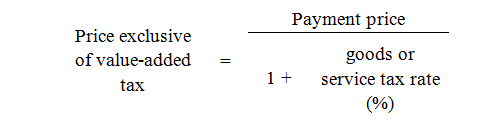

j/ For goods and services for which payment documents indicating payment prices inclusive of value-added tax are used, the taxable price is determined according to the following formula:

2. Taxable prices of goods and services specified in Clause 1 of this Article include surcharges and additional charges to be enjoyed by business establishments.

3. Taxable prices are determined in Vietnam dong. In case taxpayers have foreign currency turnover, such turnover must be converted into Vietnam dong at the average exchange rate on the inter-bank foreign currency market, announced by the State Bank of Vietnam at the time turnover is generated, for the determination of taxable prices.

Article 8. Tax rates

1. The tax rate of 0% applies to exported goods and services, international transportation and goods and services not liable to value-added tax specified in Article 5 of this Law upon exportation, except cases of transfer of technologies or intellectual property rights abroad; offshore reinsurance services; credit provision, capital transfer and derivative financial services; post and telecommunications services; and exported products which are unprocessed mined resources and minerals specified in Clause 23, Article 5 of this Law.

2. The tax rate of 5% applies to the following goods and services:

a/ Clean water for production and daily life;

b/ Fertilizers; ores for fertilizer production; insecticides, pesticides and plant and animal growth stimulators;

c/ Feeds for cattle, poultry and other domestic animals;

d/ Services of digging, embanking and dredging canals, ditches, ponds and lakes for agricultural production; growing, tending, and preventing pests and insects for, plants; preliminary processing and preservation of agricultural products;

e/ Unprocessed cultivation, husbandry and fishery products, except products specified in Clause 1, Article 5 of this Law;

f/ Preliminarily processed rubber latex; preliminarily processed turpentine; nets, main ropes and fibers for making fishing-nets;

g/ Fresh and live food; unprocessed forest products, except timber, bamboo shoots and products specified in Clause 1, Article 5 of this Law;

h/ Sugar; by-products in sugar production, including molasses, bagasse and sludge;

i/ Products made of jute, rush, bamboo, leaf, straw, coconut husks and shells and Eichhornia crassipes, and other handicrafts made of agricultural raw materials; preliminarily processed cotton; paper for newspaper printing;

j/ Special-purpose machinery and equipment for agricultural production, including ploughing machines, harrowing machines, rice-planting machines, seeding machines, rice-plucking machines, reaping machines, combine harvesters, agricultural product harvesters, insecticide or pesticide pumps or sprayers;

k/ Medical equipment and instruments; medical cotton and bandage; preventive and curative medicines; pharmaco-chemistry products and pharmaceuticals used as raw materials for the production of curative and preventive medicines;

l/ Teaching and learning aids, including models, figures, boards, chalk, rulers, compasses, and equipment and tools exclusively used for teaching, research and scientific experiments;

m/ Cultural, exhibition, physical training and sports activities; art performances; film production; film import, distribution and screening;

n/ Children toys; books of all kinds, except books specified in Clause 15, Article 5 of this Law;

o/ Scientific and technological services under the Law on Science and Technology.

3. The tax rate of 10% applies to goods and services not listed in Clauses 1 and 2 of this Article.

Article 9. Tax calculation methods

Value-added tax calculation methods include value-added tax credit method and method of calculation of tax based directly on added value.

Article 10. Tax credit method

1. The value-added tax credit method is specified as follows:

a/ The payable value-added tax amount according to the tax credit method is the output value-added tax amount minus the creditable input value-added tax amount;

b/ The output value-added tax amount is the total amount of value-added tax on sold goods and services indicated in the added-value invoice;

c/ The creditable input value-added tax amount is the total value-added tax amount indicated in the added-value invoice on goods or service purchase and the document proving the payment of value-added tax on imported goods, and must satisfy the conditions specified in Article 12 of this Law.

2. The tax credit method applies to business establishments which fully observe regulations on accounting, invoices and documents as prescribed by the law on accounting, invoices and documents, and register to pay tax according to the tax credit method.

Article 11. Method of calculation of tax based directly on added value

1. The method of calculation of tax based directly on added value is specified as follows:

a/ The payable value-added tax amount according to the method of calculation of tax based directly on added value is the added value of sold goods or services multiplied by the value-added tax rate;

b/ The added value is the selling price of goods or services minus the purchase price of such goods or services.

2. The method of calculation of tax based directly on added value applies to the following cases:

a/ Business establishments and foreign business organizations and individuals without Vietnam-based resident establishments but having incomes generated in Vietnam that fail to fully observe regulations on accounting, invoices and documents;

b/ Gold, silver and gem trading activities.

Chapter III. TAX CREDIT AND REFUND

Article 12. Input value-added tax credit

1. Business establishments which pay value-added tax according to the tax credit method are entitled to input value-added tax credit as follows:

a/ Input value-added tax on goods or services used for the production or trading of goods or services subject to value-added tax may be wholly credited;

b/ For goods or services used for the production and trading of goods or services both subject and not subject to value-added tax, only the amount of input value-added tax on goods or services used for the production and trading of goods or services subject to value-added tax is creditable. The input value-added tax on fixed assets used for the production and trading of goods or services both subject and not subject to value-added tax may be wholly credited;

c/ The input value-added tax on goods or services sold to organizations or individuals that use humanitarian or non-refundable aid capital may be wholly credited;

d/ The input value-added tax arising in a month shall be declared and credited upon the determination of the payable tax amount of that month. In case a business establishment detects errors in the declared or credited input value-added tax amount, additional declaration and credit may be conducted; the maximum time limit for additional declaration and credit is 6 months from the time of detecting errors.

2. Conditions on a business establishment to be entitled to input value-added tax credit are specified as follows:

a/ Having an added-value invoice on goods or service purchase or a document proving the payment of value-added tax at the stage of importation;

b/ Having a via-bank payment document of purchased goods or services, except goods or services valued at under twenty million Vietnam dong upon each time of purchase;

c/ For exported goods and services, apart from the conditions specified at Points a and b of this Clause, the business establishment must also have a contract signed with a foreign party on goods sale or processing or service provision, a goods or service sale invoice, a via-bank payment document and a customs declaration.

Payment for exported goods or services by clearing between exported goods or services and imported goods or services or paying debts on behalf of the State is regarded as via-bank payment.

Article 13. Cases eligible for tax refund

1. Business establishments which pay value-added tax according to the tax credit method are entitled to value-added tax refund if, for three or more consecutive months, they have some input value-added tax amount not yet fully credited.

Business establishments having registered to pay value-added tax according to the tax credit method are entitled to tax refund if they have new investment projects and some amount of value-added tax on purchased goods or services used for investment not yet fully credited and the remaining tax amount of two hundred million Vietnam dong or more.

2. Business establishments which export goods or services in a month are entitled to value-added tax refund on a monthly basis if they have a non-credited input value-added tax amount of two hundred million Vietnam dong or more.

3. Business establishments which pay value-added tax according to the tax credit method are entitled to value-added tax refund if upon ownership transformation, enterprise transformation, merger, consolidation, separation, split, dissolution, bankruptcy or operation termination, they have an overpaid value-added tax amount or have some input value-added tax amount not yet fully credited.

4. Business establishments possessing value-added tax refund decisions issued by competent agencies as provided for by law, and cases eligible for value-added tax refund under treaties to which the Socialist Republic of Vietnam is a contracting party.

Article 14. Invoices and documents

1. Goods and service purchase and sale must be accompanied by invoices and documents according to law and the following regulations:

a/ Business establishments which pay value-added tax according to the tax credit method shall use added-value invoices; such an invoice must be filled in fully and properly, displaying all surcharges and additional charges (if any). In case value-added tax-subject goods or services are sold with added-value invoices that do not indicate value-added tax amounts, the output value-added tax shall be determined to be the payment price indicated in the invoice multiplied by the value-added tax rate, except cases specified in Clause 2 of this Article;

b/ Business establishments which pay tax according to the method of calculation of tax based directly on added value shall use sale invoices.

2. For stamps and tickets which are payment documents pre-printed with payment prices, those prices are inclusive of value-added tax.

Chapter IV. IMPLEMENTATION PROVISIONS

Article 15. Implementation effect

1. This Law takes effect on January 1, 2009.

2. This Law replaces the following laws:

a/ The 1997 Law on Value-Added Tax;

b/ Law No. 07/2003/QH11 Amending and Supplementing a Number of Articles of the Law on Value-Added Tax;

3. To annul Article 2 of Law No. 57/2005/QH11 Amending and Supplementing a Number of Articles of the Law on Excise Tax and the Law on Value-Added Tax.

Article 16. Implementation guidance

The Government shall detail and guide the implementation of Articles 5, 7, 8, 12 and 13 and other necessary contents of this Law to meet management requirements.

This Law was passed on June 3, 2008, by the 12th National Assembly of the Socialist Republic of Vietnam at its third session.

—

2. Law 31/2013/QH13 (Amending Law 13/2008/QH12)

LAW 31/2013/QH13

June 19, 2013

Law Amending and Supplementing a Number of Articles of the Law on Value-Added Tax

Pursuant to the 1992 Constitution of the Socialist Republic of Vietnam, which was amended and supplemented under Resolution No. 51/2001/QH10;

The National Assembly promulgates the Law Amending and Supplementing a Number of Articles of Law No. 13/2008/QH12 on Value-Added Tax.

Article 1.

To amend and supplement a number of articles of the Law on Value-Added Tax

1. To amend and supplement Clauses 4, 7, 8, 11, 15, 17, 23 and 25, Article 5 as follows:

“4. Salt products made of seawater, natural rock salt, refined salt and iodized salt in which sodium chloride (NaCl) is a major component.”

“7. Life insurance, health insurance, student insurance, other human-related insurance services; insurance for domestic animals, insurance for plants, other agricultural insurance services; insurance for ships, boats, equipment and other necessary equipment for fishing; and reinsurance.

8. The following financial, banking and securities trading services:

a/ Credit provision services, including lending; discount and rediscount of negotiable instruments and other valuable papers; guarantee; financial lease; credit card issuance; domestic factoring; international factoring; and other forms of credit provision as prescribed by law;

b/ Lending services of taxpayers that are not credit institutions;

c/ Securities trading, including securities brokerage; securities dealing; securities issuance guarantee; securities investment consultancy; securities depository; management of securities investment funds; management of securities investment portfolio; market organizing service of stock exchanges or securities trading centers; and other securities trading activities as prescribed by the law on securities;

d/ Capital transfer, including transfer of part or the whole of invested capital, including the case of selling enterprises to other enterprises for production, business or securities transfer; and other forms of capital transfer as prescribed by law;

dd/ Selling debts;

e/ Foreign currency trading;

g/ Derivative financial services, including interest rate swapping, forward contracts, futures contracts; foreign currency trading options; and other derivative financial services as prescribed by law;

h/ Selling security property of debts of government-established organizations of which 100 percent of chartered capital is held by the State to deal with bad debts of Vietnam’s credit institutions.”

“11. The service of maintenance of zoos, flower gardens, parks, street greeneries and public lighting; and funeral services.”

“15. Publication, import and distribution of newspapers, journals, specialized bulletins, political books, textbooks, teaching materials, law books, scientific-technical books, books printed in ethnic minority languages, and propaganda paintings, pictures and posters, including those in the forms of audio or visual tapes or discs or electronic data; money and money printing.”

“17. Machinery, equipment, parts and supplies which cannot be manufactured at home and need to be imported for direct use in scientific research and technological development; machinery, equipment, spare parts, special-purpose means of transport and supplies which cannot be manufactured at home and need to be imported for prospecting, exploring and developing oil and gas fields; aircraft, drilling platforms and ships which cannot be manufactured at home and need to be imported for the formation of enterprises’ fixed assets or which are hired from foreign parties for production and business activities or for lease and sublease.”

“23. Exported products which are mined resources or minerals and have not been processed into other products.”

“25. Goods and services of business households or individuals with annual turnover of one hundred million Vietnam dong or less.

Establishments trading in goods or services not subject to value-added tax specified in this Article are not entitled to input value-added tax credit or refund, except the cases subject to the tax rate of 0% specified in Clause 1, Article 8 of this Law.”

2. To amend and supplement Points a, b, and d, Clause 1, Article 7 as follows:

“a/ For goods and services sold by production and business establishments, the taxable price is the selling price exclusive of value-added tax. For excise tax-liable goods and services, the taxable price is the selling price inclusive of excise tax but exclusive of value-added tax; for environmental protection tax-liable goods, the taxable price is the selling price inclusive of environmental protection tax but exclusive of value-added tax; for excise tax and environmental protection tax-liable goods, the taxable price is the selling price inclusive of excise tax and environmental protection tax but exclusive of value-added tax;

b/ For imported goods, the taxable price is the border-gate import price plus import tax (if any), excise tax (if any) and environmental protection tax (if any). The border-gate import price is determined under regulations on prices for calculating import tax;”

“d/ For asset lease, the taxable price is the rent exclusive of value-added tax;

In case of asset lease for which rents are paid periodically or in advance for the lease duration, the taxable price is the rent paid periodically or in advance, exclusive of value-added tax;”

3. To amend and supplement Clause 1, Article 8; to supplement Point q to Clause 2, Article 8 as follows:

“1. The tax rate of 0% applies to exported goods and services, international transportation and goods and services not liable to value-added tax specified in Article 5 of this Law upon exportation, except the following cases:

a/ Transfer of technologies or intellectual property rights abroad;

b/ Offshore reinsurance services;

c/ Credit provision services;

d/ Capital transfer;

dd/ Derivative financial services;

e/ Post and telecommunications services;

g/ Exported products being mined resources and minerals that have not been processed into other products specified in Clause 23, Article 5 of this Law.

Exported goods and services are goods and services used abroad and in non-tariff areas; and goods and services supplied to foreign customers under the Government’s regulations.”

“2. The tax rate of 5% applies to the following goods and services:

q/ Selling, leasing, and leasing-purchasing social houses in accordance with the Housing Law.”

4. To amend and supplement Article 10 as follows:

“Article 10. Tax credit method

1. The value-added tax credit method is specified as follows:

a/ The payable value-added tax amount according to the tax credit method is the output value-added tax amount minus the creditable input value-added tax amount;

b/ The output value-added tax amount is the total amount of value-added tax on sold goods or services indicated on the added-value invoice;

The value-added tax on sold goods or services indicated on the added-value invoice is the taxable price of tax-subject sold goods or services multiplied by their value-added tax rate.

In case payment documents indicating payment prices inclusive of value-added tax are used, the output value-added tax is determined to be payment price minus the value-added taxable price specified at Point k, Clause 1, Article 7 of this Law;

c/ The creditable input value-added tax amount is the total value-added tax amount indicated on the added-value invoice on goods or service purchase and the document proving the payment of value-added tax on imported goods, and must satisfy the conditions specified in Article 12 of this Law.

2. The tax credit method applies to business establishments which fully observe regulations on accounting, invoices and documents as prescribed by the law on accounting, invoices and documents and include:

a/ Business establishments with annual revenues of one billion Vietnam dong or more from selling goods and providing services, excluding business households and individuals;

b/ Business establishments voluntarily registering to apply the value-added tax credit method, excluding business households and individuals;

3. The Government shall detail this Article.”

5. To amend and supplement Article 11 as follows:

“Article 11. Method of calculation of tax based directly on added value

1. The payable value-added tax amount according to the method of calculation of tax based directly on added value is the added value multiplied by the value-added tax rate applied to gold, silver and gem sale, purchase and processing.

The added value of gold, silver or gem is determined by the selling price of gold, silver or gem minus the purchase price of such gold, silver or gem.

2. The payable value added tax amount according to the method of calculation of tax based directly on added value is the percentage multiplied by turnover as follows:

a/ Subjects of application:

– Businesses and cooperatives with annual turnover of below one billion Vietnam dong, excluding those making voluntary registration for the application of the tax credit method stipulated in Clause 2, Article 10 of this Law;

– Business households and individuals;

– Foreign business organizations and individuals without Vietnam-based resident establishments but having incomes generated in Vietnam that fail to fully observe regulations on accounting, invoices and documents, excluding foreign organizations and individuals providing goods and services for oil and gas prospecting, exploration, development and exploitation and having their tax credited and paid by the Vietnamese side.

– Other economic entities, excluding those making registration for the application of the tax credit method stipulated in Clause 2, Article 10 of this Law;

b/ The percentage used for calculating value-added tax is stipulated as follows:

– Goods distribution and supply: 1%;

– Services, construction that does not cover materials: 5%.

– Production, transport and services associated with goods, construction that covers materials: 3%.

– Other business activities: 2%”.

6. To amend and supplement Article 12 as follows:

“Article 12. Input value-added tax credit

1. Business establishments which pay value-added tax according to the tax credit method are entitled to input value-added tax credit as follows:

a/ Input value-added tax on goods or services used for the production or trading of goods or services subject to value-added tax may be wholly credited, including uncompensated input value-added tax of lost goods and services subject to value added tax;

b/ For goods or services used for the production and trading of goods or services both subject and not subject to value-added tax, only the amount of input value-added tax on goods or services used for the production and trading of goods or services subject to value-added tax is creditable. Business establishments shall separately account credited and non-credited input value added tax amounts; in case separate accounting is impossible, the credited input tax is determined according to the proportion of the turnover from value added tax-liable goods and services to the total turnover from sold goods and services;

c/ The input value-added tax on goods or services sold to organizations or individuals using humanitarian aid or non-refundable aid is wholly credited;

d/ The input value-added tax on goods or services used in prospecting, exploring and developing oil and gas fields is wholly credited;

dd/ The input value-added tax arising in a month must be declared and credited when determining the payable tax amount of that month. In case a business establishment detects errors in the declared or credited input value-added tax amount, it may make additional declaration and credit before the tax agency announces its decision on tax examination and inspection at the taxpayer’s headquarters.

2. Conditions for input value-added tax credit are specified as follows:

a/ Having an added-value invoice on goods or service purchase or a document proving the payment of value-added tax at the stage of importation;

b/ Having a non-cash payment document of purchased goods or services, except goods or services valued at under twenty million Vietnam dong upon each time of purchase;

c/ For exported goods and services, apart from the conditions specified at Points a and b of this Clause, the business establishment must also have a contract signed with a foreign party on goods sale or processing or service provision; a goods or service sale invoice; a non-cash payment document; and a customs declaration on exported goods.

Payment for exported goods or services by clearing between exported goods or services and imported goods or services, or payment of debts on behalf of the State is regarded as non-cash payment.

7. To amend and supplement Article 13 as follows:

“Article 13. Cases eligible for tax refund

1. When business establishments that pay value-added tax according to the tax credit method have their input value-added tax amounts not fully credited within a month or a quarter, they may have such tax amounts credited in the following period; in case the value-added tax amount is not fully credited after at least twelve months from the first month or at least four quarters from the first quarter in which the value-added tax amount arises, business establishments are entitled to tax refund.

A business establishment having registered to pay value-added tax according to the tax credit method is entitled to tax refund if it has a new investment project and has an amount of value-added tax on purchased goods or services used for investment not yet credited and the remaining tax amount is three hundred million Vietnam dong or more.

2. Business establishments that export goods or services in a month or a quarter are entitled to value-added tax refund on a monthly or quarterly basis if they have a uncredited input value-added tax amount of three hundred million Vietnam dong or more.

3. Business establishments that pay value-added tax according to the tax credit method are entitled to value-added tax refund if upon ownership transformation, enterprise transformation, merger, consolidation, separation, split, dissolution, bankruptcy or operation termination, they have an overpaid value-added tax amount or have some input value-added tax amount not yet fully credited.

4. Foreigners and overseas Vietnamese holding passports or entry papers granted by competent foreign agencies are entitled to tax refund for goods purchased in Vietnam and carried along when leaving the country.

5. The value-added tax refund for programs and projects using non-refundable official development assistance (ODA) or non-refundable aid or humanitarian aid is stipulated as follows:

a/ Owners of programs and projects or principal contractors or organizations designated by foreign donors to manage programs and projects using non-refundable official development assistance are entitled to the refund of value-added tax already paid on goods and services purchased in Vietnam for such programs and projects;

b/ Organizations in Vietnam using non-refundable aid and humanitarian aid of foreign organizations and individuals to buy goods and services used in non-refundable aid and humanitarian aid programs and projects in Vietnam are entitled to the refund of value-added tax on such goods and services.

6. Subjects enjoying diplomatic preferences and immunities in accordance with the law on diplomatic preferences and immunities are entitled to the refund of value-added tax amounts indicated on added value invoices or payment documents that indicate payments prices inclusive of value-added tax.

7. Business establishments possessing value-added tax refund decisions issued by competent agencies in accordance with law, and cases eligible for value-added tax refund under treaties to which the Socialist Republic of Vietnam is a contracting party.”

Article 2.

1. This Law takes effect on January 1, 2014, excluding Clauses 2 and 3 of this Article.

2. To apply the tax rate of 5% on selling, leasing and leasing-purchasing social houses specified in Clause 3, Article 1 of this Law from July 1, 2013.

3. To reduce by 50% the value-added tax rate of 10% on selling, leasing, leasing and purchasing commercial houses being completed apartments with a floor area of below 70 m2 each and the selling price of below VND 15 million/m2 each, from July 1, 2013, through June 30, 2014.

4. The Government shall detail and guide the implementation of articles and clauses of this Law as assigned.

This Law was passed on June 19, 2013, by the XIIIth National Assembly of the Socialist Republic of Vietnam at its fifth session.

—

3.Law 71/2014/QH13 (Amending Law 13/2008/QH12)

LAW 71/2014/QH13

November 26, 2014

Amending and Supplementing a Number of Articles

of the Laws on Taxes

Article 3.

To amend and supplement a number of articles of Law No. 13/2008/QH12 on Value-Added Tax, which was amended and supplemented under Law No. 31/2013/QH13.

1. To add the following 3a to Clause 3, Article 5:

“3a. Fertilizers; machinery, special-use equipment for agricultural production; offshore fishing vessels; and feeds for cattle, poultry and other domestic animals;”

2. To amend and supplement Point b, Clause 2, Article 8 as follows:

“b/ Ores for fertilizer production; pesticides and plant and animal growth stimulants;”

3. To annul Points c and k, Clause 2, Article 8.

[…]

Article 6.

1. This Law takes effect on January 1, 2015.

[…]

c/ Clause 3, Article 7 of Law No. 13/2008/QH12 on Value-Added Tax, which was amended and supplemented under Law No. 31/2013/QH13;

[…]

5. The Government and competent agencies shall detail articles and clauses in this Law as assigned.

This Law was passed on November 26, 2014, by the XIII th National Assembly of the Socialist Republic of Vietnam at its 8th session.

—

4. Law 106/2016/QH13 (Amending Law 13/2008/QH12)

LAW 106/2016/QH13

April 6, 2016

Amending and Supplementing a Number of Articles of the Law on Value-Added Tax, the Law on Excise Tax and the Law on Tax Administration

Pursuant to the Constitution of the Socialist Republic of Vietnam;

The National Assembly promulgates the Law Amending and Supplementing a Number of Articles of Law No. 13/2008/QH12 on Value-Added Tax which was amended and supplemented under Law No. 31/2013/QH13, Law No. 27/2008/QH12 on Excise Tax which was amended and supplemented under Law No. 70/2014/QH13, and Law No. 78/2006/QH11 on Tax Administration which was amended and supplemented under Law No. 21/2012/QH13 and Law No. 71/2014/QH13.

Article 1

To amend and supplement a number of articles of Law No. 13/2008/QH12 on Value-Added Tax which was amended and supplemented under Law No. 31/2013/QH13 as follows:

1. To amend Clauses 1, 9 and 23, Article 5 as follows:

“1. Cultivation and husbandry products, and reared and fished aquatic products which have not yet been processed into other products or have been just preliminarily processed and sold by producing and fishing organizations and individuals, and products at the stage of importation.

Enterprises and cooperatives that purchase cultivation and husbandry products, and reared and fished aquatic products which have not yet been processed into other products or have been just preliminarily processed for sale to other enterprises and cooperatives are not required to declare, calculate and pay value-added tax, and may have input value-added tax credited.”

“9. Healthcare and animal health services, including medical examination and treatment and preventive services for humans and domestic animals; and healthcare services for the elderly and disabled.”

“23. Exported products which are mined natural resources or minerals not yet processed into other products; or which are goods processed from mined natural resources and minerals with the total value of natural resources and minerals plus energy cost accounting for at least 51% of the product costs.”

2. To amend and supplement Point g, Clause 1, Article 8 as follows:

“g/ Exported products prescribed in Clause 23, Article 5 of this Law.

Exported goods and services are goods and services used outside Vietnam and in non-tariff areas; and goods and services supplied to foreign customers under the Government’s regulations.”

3. To amend and supplement Clauses 1 and 2, Article 13 as follows:

“1. A business establishment that pays value-added tax according to the tax credit method and has the input value-added tax amount not yet fully credited in a month or a quarter may have such tax credited in the next period.

A business establishment that has registered to pay value-added tax according to the tax credit method shall be entitled to tax refund if it has a new project currently in the investment phase and has an amount of value-added tax on purchased goods or services used for investment not yet credited while the remaining tax amount is VND 300 million or more.

A business establishment shall not be entitled to value-added tax refund but may carry forward the value-added tax amount not yet credited under its investment projects to the next period under the investment law if:

a/ The investment project fails to have sufficient charter capital as registered; the business establishment conducts conditional business investment lines but fails to fully satisfy the business conditions prescribed in the Investment Law or fails to maintain business conditions during its operation;

b/ The investment project on mining natural resources and minerals is licensed on or after July 1, 2016, or the investment project on product or goods production with the total value of natural resources and minerals plus energy cost accounting for at least 51% of the product costs.

The Government shall prescribe in detail this Clause.

2. A business establishment that exports goods or services in a month or quarter shall be entitled to value-added tax refund on a monthly or quarterly basis if it has a non-credited input value-added tax amount of VND 300 million or more, except goods imported for export or goods for export but not exported in customs operation areas under the Customs Law. Taxpayers that produce exported goods and do not violate the tax or customs law during 2 consecutive years and taxpayers that are not prone to high risks under the Law on Tax Administration shall be entitled to tax refund before customs inspection.”

[…]

Article 4

1. This Law takes effect on July 1, 2016, except the provisions of Clause 2 of this Article.

[…]

3. The Government shall detail the articles and clauses as assigned in this Law.

This Law was passed on April 6, 2016, by the XIIIth National Assembly of the Socialist Republic of Vietnam at its 11th session./.